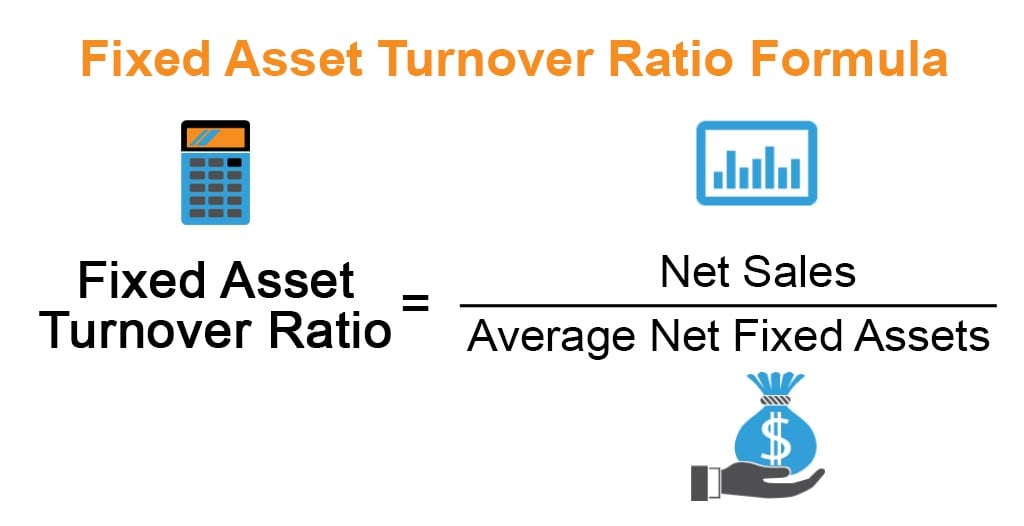

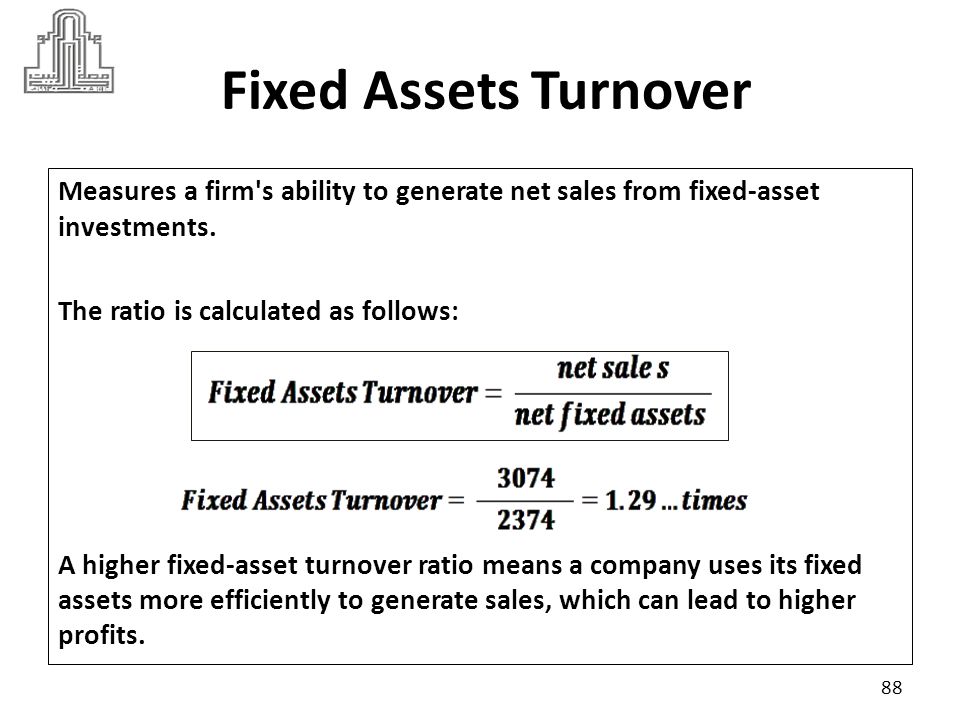

These ratios generally combine income statement information in the numerator and balance sheet information in the denominator. In case you want to calculate the fixed asset turnover ratio by average fixed assets, its can be calculated by dividing the sum of beginning and ending fixed assets by 2. They measure how efficiently a company performs its daily tasks such as managing its various assets. The calculation of fixed asset turnover can be calculated as net sales divided by average property, plant, and equipment as the following formula.įixed asset turnover ratio = Net sales ÷ Net fixed assetsįixed asset turnover ratio = Net sales ÷ Average fixed aseets

The higher fixed asset turnover ratio, the more efficiently the business management their fixed asset.The fixed asset turnover ratio also known as the PP&E turnover ratio (property, plant and equipment).Fixed asset turnover is an asset management tool to evaluate the sales that the business generated for each dollar of fixed assets.Once the business hits the maximum capacity, this means the business cannot increase their production (and their sales) anymore. However, if the fixed asset turnover ratio is too high (I mean extremely high), the business may be close to the maximum capacity. In contrast, the lower levels of fixed asset turnover ratio indicate that the business cannot (or just not) using their fixed asset efficiently to generate their sales, this might also indicate bad business management. Normally, the higher fixed asset turnover ratio, the more efficiently the business management their fixed asset. The ratio is a summarize the efficiency in a business using their fixed asset. Fixed asset turnover ratio = Net sales ÷ Net fixed assets.The fixed asset turnover ratio is also known as the PP&E turnover ratio (PP&E stands for property, plant, and equipment). The fixed asset turnover ratio is a comparison between net sales and net fixed assets which includes: property, plant, and equipment. The fixed asset turnover ratio formula is calculated by dividing net sales by the total property, plant, and equipment net of accumulated depreciation. The fixed asset turnover ratio will show the number of dollars in sales that the business generated for each dollar of fixed assets. Microsoft Corp (MSFT) Fixed Asset Turnover: 2.62 for the quarter ended March 31st, 2023 From 2009 to 2023 Microsoft Corps highest quarterly fixed asset.

Fixed asset turnover ratio is an asset management tool to evaluate the appropriateness of the level of a company’s property, plant and equipment. Return to Article Details Effects of inventory turnover, total asset turnover, fixed asset turnover, current ratio and average collection period on.

0 kommentar(er)

0 kommentar(er)